www tax ny gov enhanced star

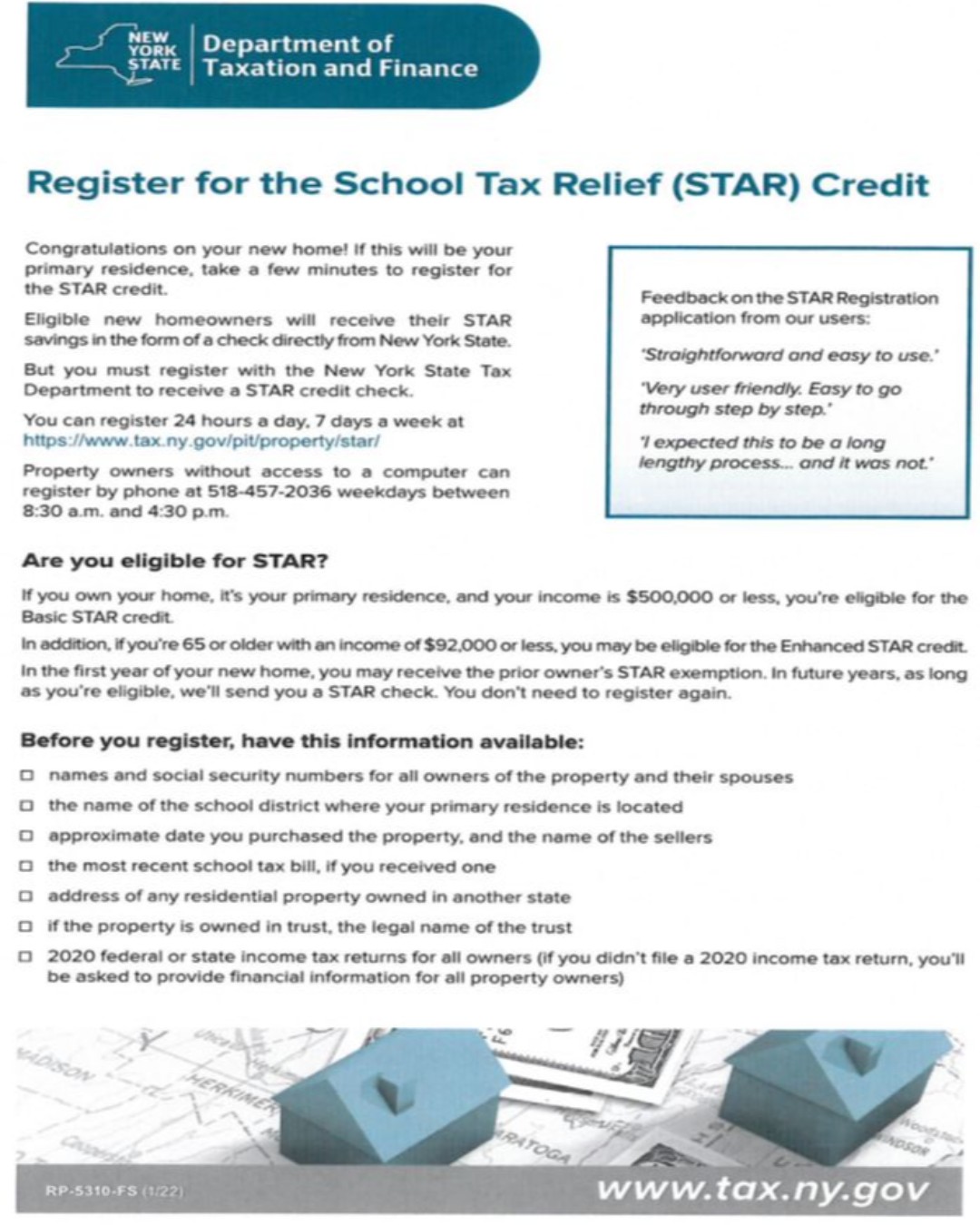

You only need to register once and the. If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit.

Enhanced Star Program Information Town Of Coeymans

Register for the Basic and Enhanced STAR credits יידיש 한국어 The STAR program can save homeowners hundreds of dollars each year.

. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000. Fill out the application completely. Enter the security code displayed below and then select Continue.

More information is available at wwwtaxnygovstar or by calling 518 457-2036. STAR Check Delivery Schedule. Enter the security code displayed below and then select Continue.

This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not. THE ENHANCED STAR EXEMPTION IS NOT TRANSFERABLE. To qualify for the.

Eligibility is based on the combined incomes of all the owners and any. You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if. The following security code is necessary to.

The following security code is necessary to prevent. To apply and are eligible for the Enhanced STAR exemption. While the NYS Department of Taxation and Finance will.

Register with the NYS. Enhanced STAR Exemption Application Deadline for Seniors is March 1st Homeowners who receive the STAR Credit check from the State instead of the STAR Exemption on their tax bill. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year.

The Enhanced STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year and wish to apply for Enhanced STAR. Travelers who want to board an airplane will soon need a star or flag on their New York state drivers license indicating that it is a REAL ID-compliant credential. The benefit is estimated to be a 293 tax reduction.

Apply For The Enhanced Star Property Tax Exemption By March 1st Tioga Opportunities Inc

02 16 2021 Assessment Community Weekly

Additional New York State Child And Earned Income Tax Payments

Register For The School Tax Relief Star Credit By July 1st Greene Government

Assessment Victor Ny Official Website

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Did You Get Your Tax Rebate Check Yet Here S How Many Haven T Gone Out

Gov Cuomo Wants To Deny Star Rebate Checks To Tax Delinquent Homeowners Wgrz Com

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Town Of Salina On Twitter Register For Basic Star Credit If Property Is Your Primary Residence Amp Income Is 500 000 Or Less Https T Co Svry6rjmdn Or By Phone Weekdays 8 30am 4 30pm 518 457 2036

Tax Collector Tax Assessor Town Of Lewis Ny

Do These 2 Things To Get Your New York State Tax Refund 2 Weeks Sooner Syracuse Com

Did You Get Your Tax Rebate Check Yet Here S How Many Haven T Gone Out